Largest Stock Exchange in the World

Leaving France behind, India has joined the list of the top 5 stock markets of the world. In January of this year, the French stock market had brought India from 5th position to 6th position. But India’s day-by-day growing market has again regained its 5th position. India’s stock market has been showing very good growth since March. This is because foreign investors are interested in making investments in India. India’s macroeconomic circumstances are greatly improving as a result.

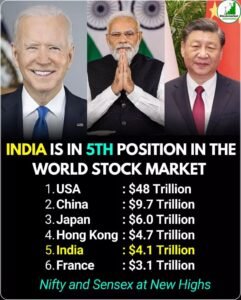

India’s market capitalization (ie how much India’s stock market has grown) is $4.1 trillion as of today. India is now in 5th place in the list of top 10 stock markets of the world. The value of the Indian stock market has increased by $330 billion since the start of the year.

5 Largest Stock Exchange In world

If we compare India’s stock market, the size of America’s stock market is 48 trillion dollars. China comes next, with a stock market worth $9.7 trillion. Japan, with $6 trillion, is ranked third. And at number four is Hong Kong, a partner with a 4.7 market size. And leaving France behind, India’s stock market stands with a 4.1 market cap.

- America – 48 Trillion$

- China – 9.7 Trillion$

- Japan – 6 Trillion$

- Hong-Kong – 4.7 Trillion$

- India – 4.1 Trillion$

- France – 3.24 Trillion$

According to Jefferies, a well-known brokerage business abroad, the Indian market is expanding quickly. Now it is just a matter of time before the BSE Sensex will cross 1,00,000. This target of Jefferies has allowed investors from all over India as well as outside India to invest money.

Nifty and Sensex at all-time high

India’s stock market is growing rapidly. Both Senses and Nifty have increased by 0.6% in the last 2 days. Nifty has touched 20,826.95 points, and the Sensex has also seen a notable rise. Sensex is currently at 69,336.44 points.

Top reasons why India’s stock market is growing rapidly

Money from outside the country: FII (Foreign Institutional Investors) i.e. investors from outside the country are investing their money in the Indian market on a large scale. Because of that India’s stock market is increasing.

US Bond Yield Down: The yield (interest in simple language) of the bonds available in the US market has gone down. And to get more interest, they invest their money in countries outside that country.

Stable Interest Rates: Be it outside the market or in India, interest rates have been quite stable for some time. The activities of the market fluctuate less as a result.

Strong Macros: Macros i.e. the economic condition of India is quite good. India’s GDP grew by 7.6% from July to September.

Another reason to grow a market

The Key is Education Start by learning the fundamentals of the stock market. Through books, online courses, or seminars, learn about different financial instruments, market trends, and investment strategies.

- Analysis and Research: Before investing, thoroughly investigate companies. To make wise decisions, examine their management, market performance, industry trends, and financial statements.

- Diversification: To reduce risk, distribute your investments among several industries and businesses. The effects of market volatility can be mitigated by a diversified portfolio.

- Long-Term View: Give up trying to make quick gains and instead take a long-term approach. In the stock market, patience frequently results in higher returns.

- Risk management: Establish upper and lower bounds for your investment and loss tolerance. To safeguard your investments, use stop-loss orders and other risk management techniques.

- Remain Up to Date: Make sure you are aware of all the news, market movements, and economic factors that may affect the stock market.

- Steer Clear of Emotional Decisions: Steer clear of rash choices motivated by feelings such as greed or fear. Adhere to your investment strategy.

- Consult Experts: Before making important investment decisions, think about getting advice from financial advisors or seasoned investors.

- Monitor and Modify: Keep a close eye on the performance of your portfolio and, if necessary, modify your approach. The way you approach investing should change as the markets do.

- Start Small: As you gain confidence and experience in the market, start with a small investment and progressively increase your exposure.

Indian stock market:

The Indian stock market, one of the oldest in Asia, serves as a bustling hub for investors, traders, and companies seeking capital. It primarily depends upon two major exchanges: the Bombay Stock Exchange known as BSE and the National Stock Exchange known as NSE. Spanning a diverse array of sectors such as IT, healthcare, finance, and manufacturing, the market reflects India’s economic landscape.

Companies in India can opt for either the BSE or NSE to list their shares, allowing them to raise funds for growth and expansion. The market comprises various indices, notably the Sensex (BSE) and Nifty (NSE), which track the performance of select stocks, offering insights into the market’s overall health.

Investors participate in the market through brokerage firms, buying and selling stocks, bonds, derivatives, and commodities. Foreign investors also play a significant role, contributing to market liquidity. Regulatory bodies like the Securities and Exchange Board of India (SEBI) oversee market operations, ensuring transparency, investor protection, and fair practices.

The market’s volatility often mirrors global economic trends, domestic policies, geopolitical events, and currency fluctuations. Additionally, it responds to domestic factors such as GDP growth, corporate earnings, inflation rates, and government reforms.

India’s stock market evolution reflects its economic journey—from liberalization in the 1990s to embracing technological advancements in trading, like online platforms and mobile apps. The market’s resilience is evident in its ability to navigate challenges, including the impact of the COVID-19 pandemic.

While the market offers opportunities for wealth creation, it also poses risks. Volatility, market sentiment, and unforeseen events can affect investment outcomes. Thus, investors often strategize, diversify portfolios, and conduct thorough research before making investment decisions.

Overall, the Indian stock market stands as a dynamic ecosystem, intertwining the aspirations of companies for growth and investors seeking opportunities, reflecting India’s economic prowess and its role in the global financial landscape.